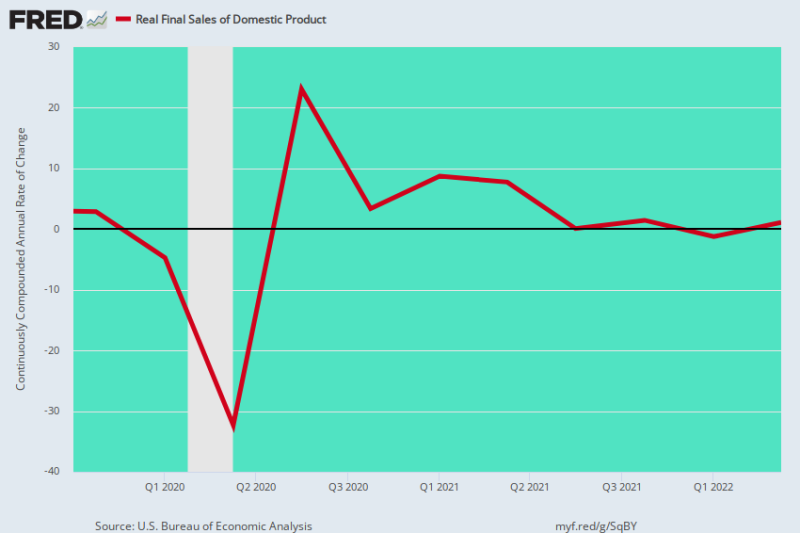

Sure, we’ve got some stagflation. Subsequent to the pre-Covid peak in This autumn 2019, actual closing gross sales of home product have slowed to a crawl, rising by simply 0.73% every year over the last 2.5 years.

We a lot choose this measure over actual GDP as a result of it removes the abrupt stock swings from quarter to quarter, which might have outsized impacts on the headline quantity. Thus, through the first two quarters of 2022 the reported back-to-back actual GDP contraction was owing to stock liquidation, not an precise shrinkage of present exercise.

Because it occurs, nevertheless, stock swings reduce each methods—so the chart beneath removes this statistical noise and will get to the underlying pattern of manufacturing, revenue and spending.

What has occurred, subsequently, is that regardless of upwards of $11 trillion of financial and monetary stimmies since This autumn 2019, the US financial system has lurched alongside a path to basically nowhere.

The unique Lockdown-induced 32% annualized plunge in Q2 2020 was adopted by a 23% annualized rebound in Q3 2020 after which a return to the pre-Covid start line by Q1/Q2 2021. Thereafter, nevertheless, this combination indicator of present financial exercise has basically oscillated alongside the flat line.

Annualized Charge of Change, Actual Last Gross sales Of Home Product:

- Q3 2021: +0.09%;

- This autumn 2021: +1.45%;

- Q1 2022: -1.24%;

- Q2 2022: +1.08%;

The previous 4 quarters would clearly be nothing to put in writing residence about, even beneath regular circumstances. However these limpid outcomes really occurred on the heels of essentially the most aggressive stimulus in recorded historical past; and in addition throughout a interval through which the rising stage of inflation was simply getting up a head of steam.

Which means because the Washington stimulus fades and major road inflation surges within the months forward, the US financial system shall be clobbered by the worst of each worlds. Accordingly, there may be each cause to anticipate that the purple line within the chart beneath will quickly drop into unfavorable territory for a number of quarters to come back.

Y/Y Change In Actual Last Gross sales Of Home Product, This autumn 2019 to Q2 2022

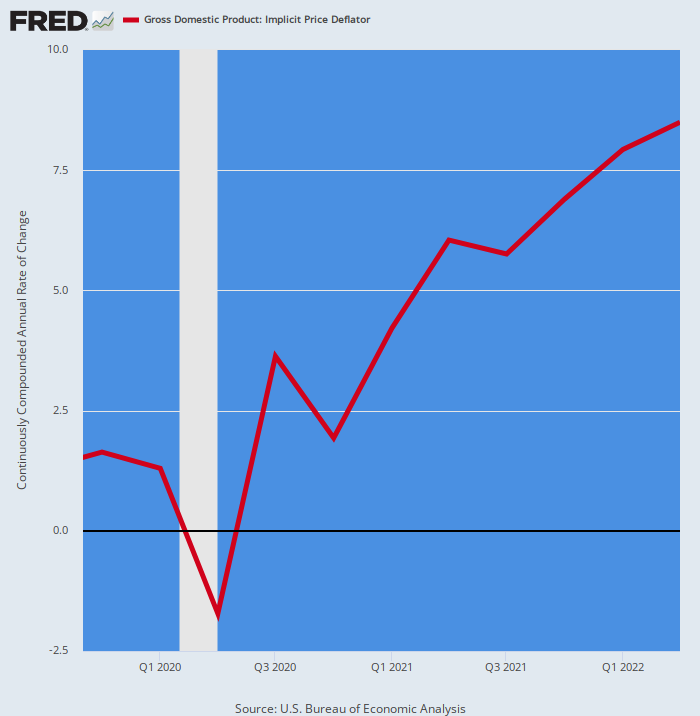

For need of doubt, right here is the annualized price of GDP deflator change for a similar 2.5 yr interval. Self-evidently, it has moved aggressively larger, the very reverse of the flagging price of acquire in actual closing gross sales.

Annualized Charge of Change In GDP Deflator:

- This autumn 2020: +1.93%;

- Q1 2021: +4.22%;

- Q2 2021: 6.04%;

- Q3 2021: +5.75%;

- This autumn 2021: +6.90%;

- Q1 2022: +7.93%;

- Q2 2022: +8.50%;

The above depicted inflation-ramp is definitely one for the file books. In truth, the final time the GDP deflator exceeded 8.50% was 42 years in the past in This autumn 1980.

It’s the rationale why the true financial system is faltering and stagflation has grow to be embedded: To wit, the positive aspects in nominal revenue are being greater than eaten up by hovering costs, paving the best way for the worst bout of excessive inflation and falling actual progress because the Nineteen Seventies.

For sure, that situation leaves the Fed excessive and dry. After years of its 2.00% inflation mantra because the be-all and end-all of macroeconomic stability and prosperity, it would haven’t any selection besides to maintain pushing up rates of interest to fight 6-9% inflation—till faltering output progress finally collapses right into a deep recession.

Y/Y Change In GDP Deflator, This autumn 2019 to Q2 2022

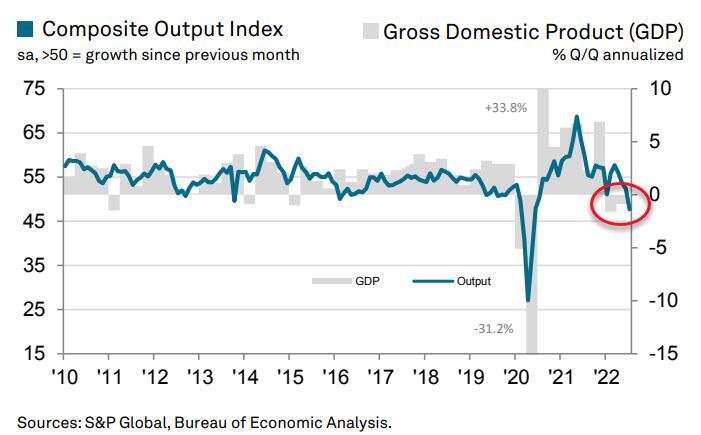

In the present day’s knowledge dump, actually, was a warning sign that the US financial system might go down for the depend as quickly as Q3. That’s as a result of the S&P International US Composite PMI Output Index posted at an abysmal 47.7 in July.

The July studying was down from 52.3 in June and indicators a renewed contraction in non-public sector enterprise exercise. As proven within the chart, GDP ordinarily follows the composite output index with a small lag.

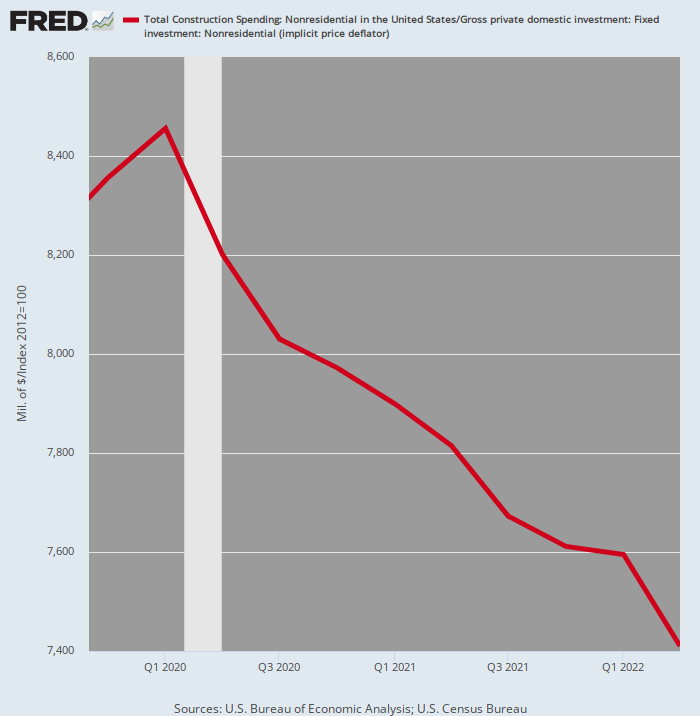

There may be loads of proof, actually, that enormous sections of the non-public sector are already heading south. For example, inflation-adjusted nonresidential building spending throughout Q2 2022 was down 12.4% from the Q1 2020 peak.

With inflation hovering we see no cause to anticipate that actual funding within the business, workplace, retail and industrial building area is more likely to reverse larger within the quarters simply forward.

Inflation-Adjusted Development Spending, Personal Nonresidential, This autumn 2019-Q2 2022

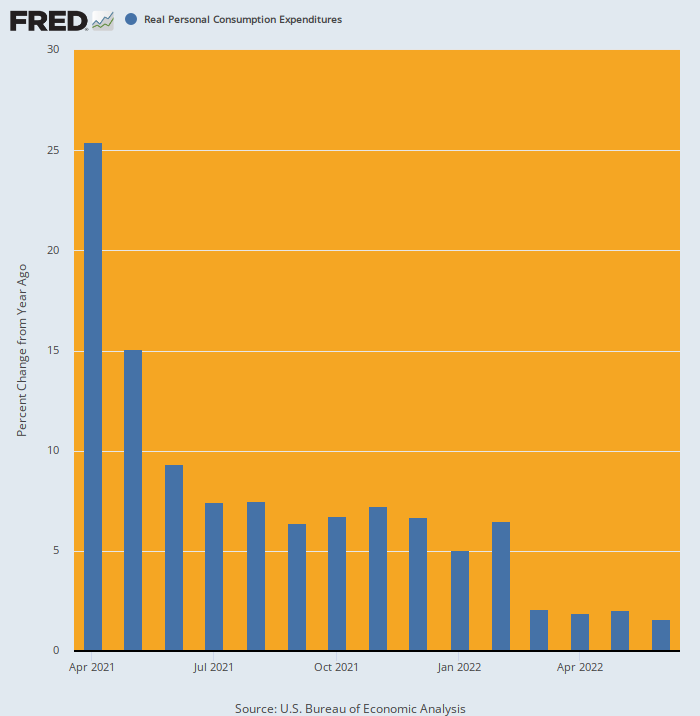

We additionally don’t see any cause for the vaunted shopper to rebound, both. In truth, from the time that actual PCE shot the moon in April 2021 owing to Joe Biden’s $1.9 trillion stimmy, family spending has been marching downhill at a relentless clip.

After rising at 5.0% Y/Y in early 2022, the June determine got here in at simply 1.5%, persevering with a steadily weakening pattern. And what lies forward is larger inflation and presumably Joe Biden’s tax will increase—the other of the bogus stimmy-boosted spending proven within the precedent days of the chart beneath.

Y/Y Change In Actual PCE, April 2021 to June 2022

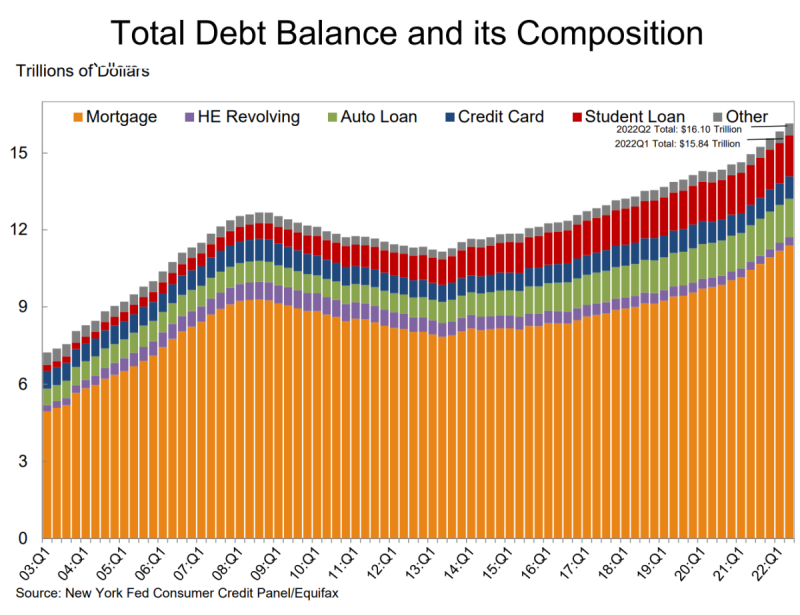

Lastly, as we speak’s Fed report on shopper debt gives only one extra nail within the coffin. It confirmed that complete family debt rose $312 billion through the second quarter to succeed in a file $16.15 trillion.

- Mortgage balances—the biggest element of family debt—climbed $207 billion and stood at $11.39 trillion as of June 30.

- Bank card balances had a $46 billion improve because the first quarter. The 13% year-over-year improve marked the biggest in additional than 20 years.

- Mixture limits on playing cards marked their largest improve in over ten years.

- And auto mortgage balances elevated by $33 billion within the second quarter, persevering with the upward trajectory that has been in place since 2011.

So, sure, shopper spending is simply barely in constructive territory in actual phrases, however that’s completely attributable to continued will increase in family debt. It is just a matter of time, nevertheless, till rising rates of interest shut off that avenue of enlargement as properly.

The loopy factor, after all, is that Wall Avenue now thinks that the Fed’s tightening section shall be over by December and that the battle towards inflation has been received, thereby enabling a brand new spherical of rate-cutting and hovering inventory costs.

Dream on!

Reposted from David Stockman’s consulting service.